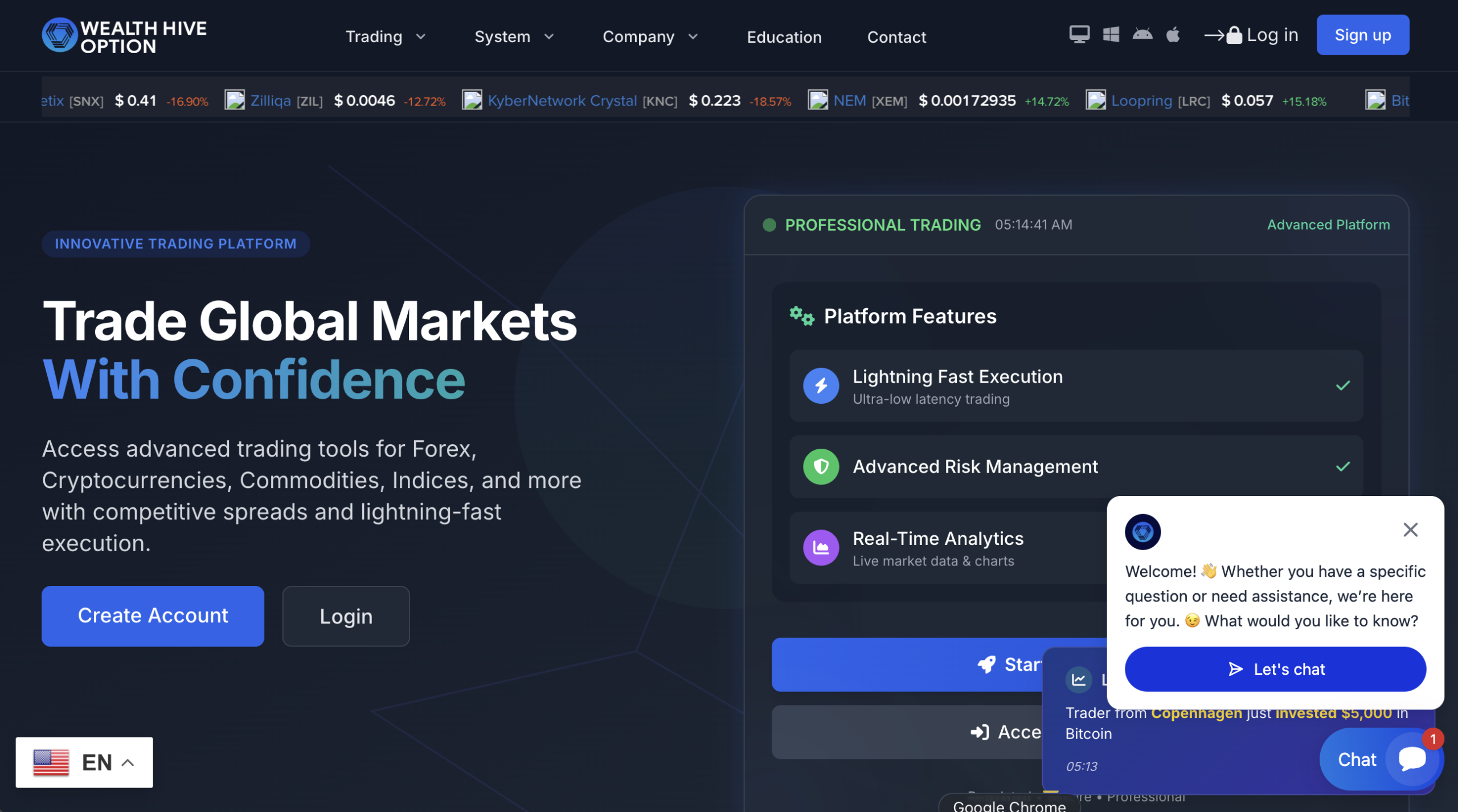

WealthHiveOption.com Platform Warning

Online investment scams continue to evolve, but some platforms raise red flags so large that they demand immediate attention. WealthHiveOption.com is one of those platforms. Despite its polished website and bold promises, the platform has already been officially flagged by the UK Financial Conduct Authority (FCA) for operating without authorization. That alone should make any investor pause — but the problems run far deeper.

This comprehensive review breaks down the platform’s tactics, exposes its deceptive practices, and explains why you should stay far away from this high‑risk operation.

Regulators Have Already Issued a Warning

The FCA has clearly stated that WealthHiveOption.com may be providing or promoting financial services without permission. This is one of the strongest warnings a financial regulator can issue. When the FCA steps in, it usually means the platform has triggered complaints, suspicious activity reports, or evidence of misconduct.

Even more concerning, the FCA notes that the platform may be targeting people in the UK, despite having no legal authorization to operate there. This is a major red flag and a common trait among fraudulent investment platforms.

When a regulator tells the public to avoid a firm, the safest response is to walk away immediately.

A Fake London Address Designed to Mislead

WealthHiveOption.com lists its address as 1 Canada Square, Canary Wharf, London — one of the most prestigious business districts in the UK. On the surface, this might reassure inexperienced investors. However, scammers frequently use well‑known financial hubs to create a false sense of legitimacy.

The FCA itself warns that fraudulent firms often provide incorrect or misleading contact details, including fake addresses. WealthHiveOption.com fits this pattern perfectly.

Additionally, the platform’s domain registration is masked, hiding the identity of the operators. Legitimate financial institutions do not hide behind anonymity. When a platform conceals its ownership, it signals that the people behind it do not want to be held accountable.

A Website That Mirrors Known Scam Patterns

WealthHiveOption.com exhibits several characteristics commonly seen in unlicensed investment scams. These include:

- Unregulated financial services: The platform offers forex, crypto, and derivatives without proper licensing.

- Recycled website templates: Scam networks often reuse the same layouts and content across multiple fraudulent sites.

- Aggressive marketing claims: Promises of high returns, guaranteed profits, or exclusive investment opportunities.

- Lack of transparency: No real team members, no verifiable company details, and no regulatory documentation.

These traits are not random. They are part of a well‑known scam model designed to lure victims, extract deposits, and disappear.

Why Unregulated Platforms Like This Are Extremely Dangerous

When you deposit money into an unregulated platform, you expose yourself to enormous risk. Unlike licensed brokers, these operations do not follow any rules or oversight. They are not required to:

- Protect client funds

- Provide audited financial statements

- Follow conduct standards

- Offer dispute resolution

This means your money can be misused, withheld, or stolen without consequence. Many victims of similar platforms report the same pattern: once they request a withdrawal, the broker delays, demands extra fees, or blocks access entirely.

WealthHiveOption.com fits this pattern perfectly.

Major Red Flags You Should Never Ignore

WealthHiveOption.com displays multiple warning signs that should immediately stop anyone from investing:

- Regulatory warnings from the FCA

- Anonymous ownership and hidden domain details

- Suspicious address usage meant to create false credibility

- High‑risk financial products offered without authorization

- Website inconsistencies that match known scam templates

When a platform triggers this many alerts, the safest decision is to avoid it entirely.

How Scam Platforms Like WealthHiveOption.com Operate

Understanding the typical scam cycle helps you recognize the danger before it’s too late. Platforms like WealthHiveOption.com often follow a predictable pattern:

- Attract victims with unrealistic promises

- Pressure users to deposit more money

- Display fake profits on the dashboard

- Block or delay withdrawals

- Shut down or rebrand under a new domain

This cycle has repeated across countless fraudulent platforms. The goal is always the same: extract as much money as possible before disappearing.

Why You Must Avoid WealthHiveOption.com

With regulatory warnings, anonymous operators, misleading claims, and a structure that mirrors known scam networks, WealthHiveOption.com is not a platform anyone should trust. The risks are too high, and the evidence is too overwhelming.

There are many legitimate, regulated brokers available. Choosing an unlicensed, suspicious platform like this one puts your money and personal information in serious jeopardy.

Final Thoughts

WealthHiveOption.com is a textbook example of a high‑risk, unlicensed investment scam. Its deceptive practices, lack of transparency, and regulatory red flags make it a platform you should avoid completely. Staying informed and recognizing these warning signs is the best way to protect yourself from online financial fraud.

Report wealthhiveoption.com And Recover Your Funds

If you have lost money to wealthhiveoption.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like wealthhiveoption.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.