York Heritage Capital Overview

In the crowded online world of financial services and investment platforms, due diligence isn’t just recommended — it’s essential. Every year, countless investors fall victim to firms that look professional on the surface but collapse into thin air when scrutiny is applied. One such platform currently raising alarm bells among fraud-detection services and online watchdogs is York Heritage Capital, operating through the domain yorkheritagecapital.com. What appears to be a legitimate wealth-management service at first glance is, upon closer examination, riddled with risk factors that suggest it could well be a scam in disguise.

In this post, we’ll break down the key warning signs tied to this platform — from its suspicious domain history to opaque ownership details — and explain, in clear language, why people should be extremely cautious and consider steering clear entirely.

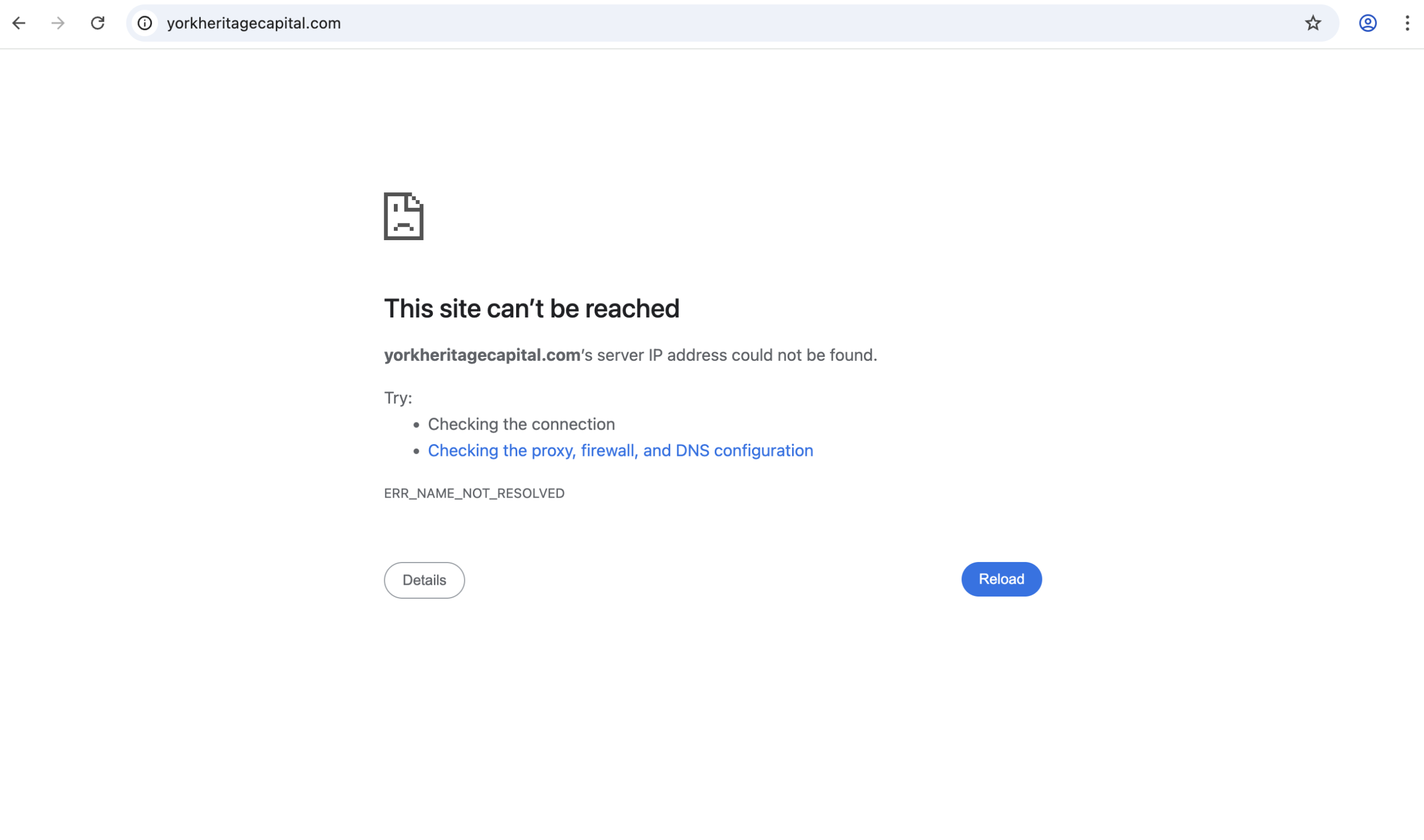

1. A Brand New Domain With No Track Record

One of the most important things experienced investors look at when evaluating an online investment service is how long it has been in operation. Legitimate financial firms typically have years — if not decades — of operational history, a traceable reputation, and a presence across independent review sites and regulatory listings.

In contrast, yorkheritagecapital.com was registered only recently (in 2025), giving it a very short online lifespan. Websites that offer financial services or investment opportunities but have only existed for a few months — especially without a known parent company — are often suspect because scammers use freshly registered domains to avoid historical scrutiny and regulatory records.

This youthful domain age is a classic red flag and undermines any confidence in the platform’s legitimacy.

2. Anonymous Ownership and Privacy-Protected Registration

Legitimate financial services firms typically boast transparent ownership — including a company registration, management team profiles, and verifiable contact details. This transparency matters because it allows customers and regulators alike to hold the company accountable.

However, yorkheritagecapital.com obscures its ownership. The domain’s WHOIS registration information is privacy-protected, meaning the real owner’s identity is hidden. While privacy protections aren’t inherently illegitimate, financial platforms that hide ownership information while soliciting investments should be treated with suspicion.

This lack of transparency eliminates a crucial accountability mechanism and makes it extremely difficult to verify whether the business is genuinely regulated or simply flying under the radar.

3. Questionable Trust Scores From Scam-Detection Tools

Independent scam-analysis tools have assigned yorkheritagecapital.com extremely low trust scores, indicating multiple risk factors tied to the domain. These sightings include:

-

A trust score that falls near the bottom of the scale.

-

Blacklisting on certain risk engines.

-

Proximity to known suspicious domains based on technical analyses.

These tools evaluate a variety of indicators, including domain age, server reputation, ownership transparency, and historical risk flags. When a financial services website scores poorly across these measures, it often suggests that something isn’t right — and this is confirmed by the unusually low scores attached to York Heritage Capital.

Such aggregated risk indicators are not definitive proof of fraud — but they are strong warning signs that should not be ignored.

4. Lack of Verified Regulatory Credentials

In many countries, offering financial advice, investment products, or wealth-management services requires registration with a financial authority (such as ASIC in Australia, the SEC in the United States, or the FCA in the UK). This regulatory oversight ensures that firms meet minimum standards of conduct, transparency, and capital adequacy.

Preliminary reviews of yorkheritagecapital.com show no publicly verifiable regulatory licenses or affiliations on the website itself. While the site may mention compliance or licensing in its privacy pages, there is no easily searchable record confirming this with any financial regulator. Lack of verifiable regulatory credentials should be interpreted as a major red flag — investors deserve to know that the entity handling their money is legally recognized and subject to oversight.

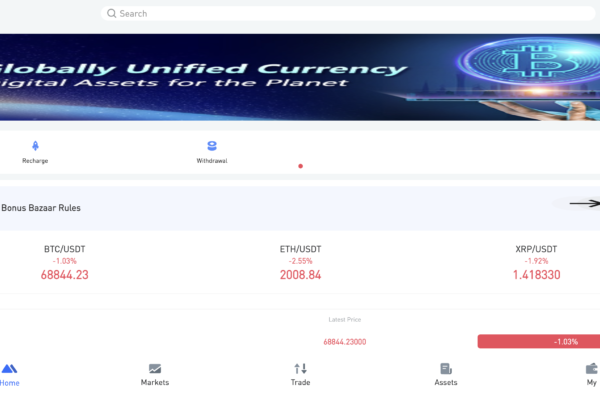

5. Professional Design, But Possibly Hollow Content

One of the most insidious aspects of modern online scams is how professionally they are presented. A sleek website with clean layout, “industry standard” copy, and stock photos can lure unsuspecting users into a false sense of security.

York Heritage Capital presents itself as a comprehensive investment advisory platform with offerings in wealth management, corporate finance, and strategic advice. The messaging is polished and designed to impress. However, surface professionalism does not equate to substance.

When there are no meaningful independent customer reviews, no regulatory verification, and no long-term operational history, the website’s slick presentation becomes a potential tool for deception rather than a sign of legitimacy.

6. Opaque Contact Information That May Mislead Investors

The site lists a business address and phone number that appear to be based in Australia. However, such contact details are relatively easy to fabricate or acquire through virtual office services. If a company isn’t willing to clearly disclose ownership and proven regulatory status, having an address or Australian phone number becomes largely meaningless to investor protection.

Scammers often copy local addresses or use phone numbers that may forward calls to overseas operators, creating a false veneer of credibility.

7. The Bottom Line: Treatment With Extreme Caution

A platform that markets itself as a financial services provider — yet checks all the boxes of a suspicious operation — should be treated with skepticism. The combination of a brand new domain, hidden ownership details, poor trust scores from independent scanners, and lack of verifiable credentials collectively places yorkheritagecapital.com into the “high risk / potentially scam” category for most prudent investors.

Whether this platform is an outright scam or simply an unverified new entrant without proper credentials, the result for you as an investor is the same: exposure to significant risk of financial loss.

Final Advice: Don’t Take the Bait

When evaluating any investment opportunity — whether it’s a stockbroker, wealth adviser, cryptocurrency exchange, or forex platform — always demand transparency. Look for:

-

Verified regulatory registration with respected oversight bodies.

-

Multi-year operational history with documented reviews.

-

Transparent ownership and leadership credentials.

-

Independent third-party reviews from reputable sources.

If a platform fails on one or more of these points — especially all of them — it’s generally best to walk away and find a more credible alternative.

In the case of York Heritage Capital, the risk profile is simply too high, and the evidence too concerning, to justify trusting this platform with your hard-earned money.

Steer clear — and always protect your financial future with verified, reputable partners.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to yorkheritagecapital.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as yorkheritagecapital.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.