ZenFundPro.com Scam Review: You Should Avoid This Platform

The allure of crypto investing platforms with sleek interfaces and promises of easy profit can be tempting. ZenFundPro.com, also known as ZenFundPro or operating via zenfund.co and zenfundpro.com, is one such site—but beneath the veneer lies numerous red flags from regulators, watchdogs, and user feedback. Here’s everything you need to know before even considering investing.

1. Regulatory Alarms—Warnings You Can’t Ignore

ZenFundPro has been officially flagged by both the German financial regulator, BaFin, and Austria’s Financial Market Authority (FMA). These warnings indicate that the platform is operating illegally in at least those jurisdictions.

AlertTrade.net

Operating without proper licensing means no oversight or protection for investors—your money is exposed without accountability.

2. Unregulated Platform with Zero Accountability

Independent evaluators, including InvestReviews, describe ZenFundPro as an unregulated and suspicious platform.

InvestReviews

Without oversight from recognized authorities like the FCA, ASIC, or CySEC, there’s no guarantee of fair behavior or legal recourse. An unregulated platform is essentially operating in the shadows.

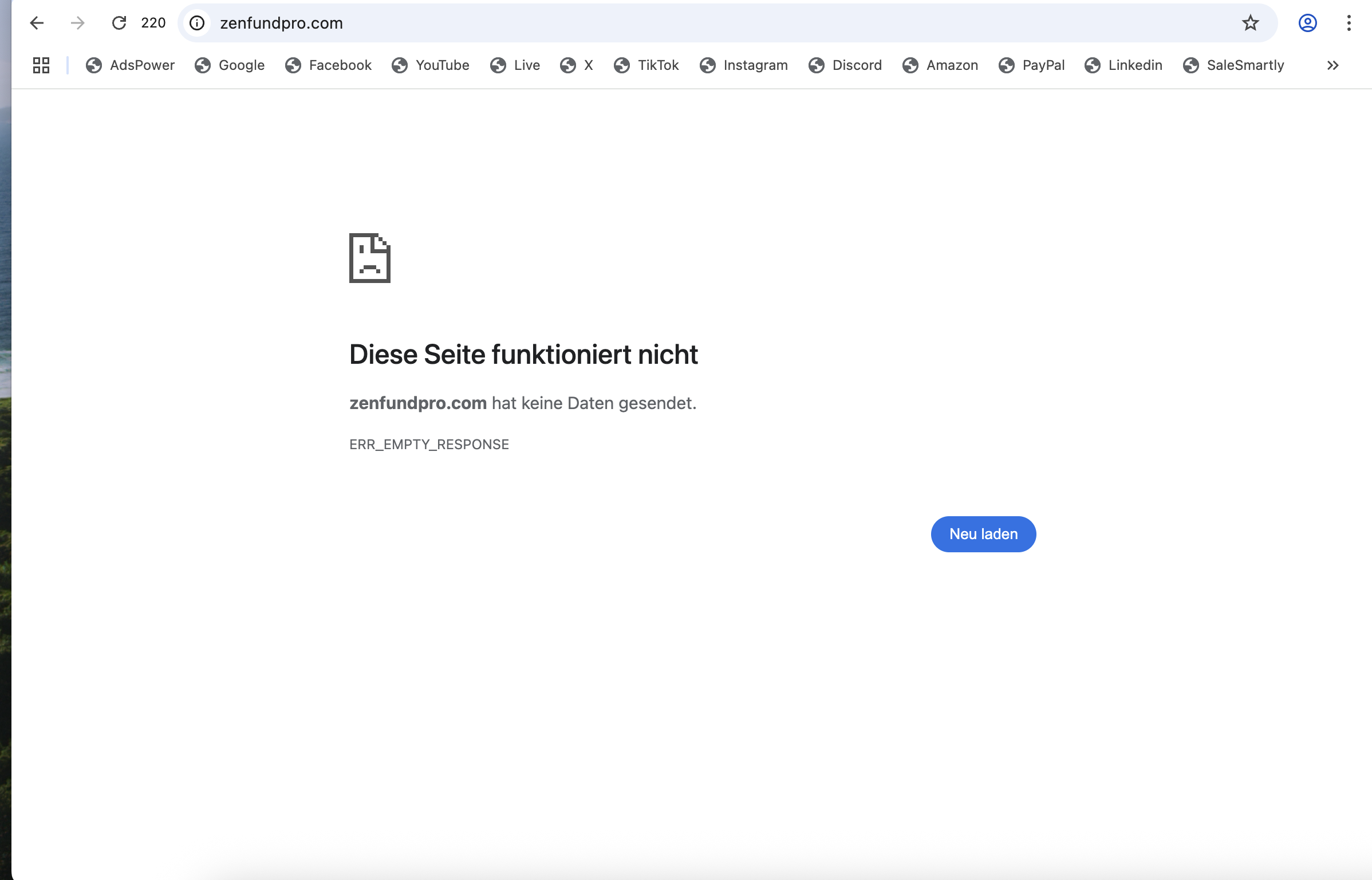

3. Slick Website, Empty Substance

Despite having polished marketing materials, independent reviews note several red flags:

-

Promises of unrealistic returns, such as doubling your investment within 24 hours

-

Use of stock images or paid actors as team members

-

Opaque withdrawal policies designed to trap funds

-

Frequent website downtime or domain changes, indicating instability

InvestReviews

These traits align with classic scam operations that lure in investors before vanishing.

4. Technical Risk Indicators—Low Trust by Design

Website safety tools are alarmed:

-

Domain is new and privately registered, with ownership concealed

-

Minimal online presence and traffic, a hallmark of fly-by-night operations

-

No meaningful reputation or user ecosystem built over time

InvestReviews

These technical markers suggest that ZenFundPro is structured for short-lived exploitation—not long-term service.

5. User Experience—Too Good to Be True, Indeed It Is

Examining real user behavior and discussion threads reveals predictable scam patterns:

-

Many platforms provide small “wins” early on to build trust, then block access when a larger withdrawal is requested

-

Investors undergo repeated delays, suspicious fee requests, or complete disappearance of customer service

InvestReviewsAlertTrade.net

Unfortunately, this is a familiar pattern across scam platforms, and ZenFundPro aligns with it closely.

6. Community Intelligence—Listening to Warnings

In forums like Reddit, participants frequently echo this advice:

“If you’re doubting whether the site is a scam, it probably is.”

“Never invest with strangers reached via social media or dating apps—it’s almost always a scam.”

These sentiments underscore the importance of trusting your gut and exercising extreme caution when dealing with suspicious platforms.

7. Scam Mechanics—The Trap Cycle

ZenFundPro appears to follow a known scheme:

-

Aggressive marketing—advertising rapid, unrealistic returns

-

Low-barrier entry, followed by simulated “profits”

-

Withdrawal delays—often blamed on technical or compliance “issues”

-

Pressure for additional deposits, or fees to unlock funds

-

Site disappearance or permanent domain change once investors question the operations

These steps are textbook building blocks of online financial scams.

8. Red Flags Summary Table

| Red Flag | Why It Matters |

|---|---|

| Regulatory warnings (BaFin & FMA) | Legal authorities confirm illegal operations |

| Unregulated status | No accountability or investor protection |

| Fake office imagery/claims | Misleading legitimacy intended to deceive |

| Anonymous domain ownership | No transparency or traceability |

| Unrealistic returns claims | Classic tactic to lure investors with false hopes |

| Poor user recall or sudden exit | Indicates a short-term scam setup |

| Community doubts & warnings | Reflects broader awareness of potential fraud |

9. Emotional & Financial Risks for Victims

Investors who fall prey to platforms like ZenFundPro may deal with:

-

Substantial financial loss, often deemed unrecoverable

-

Emotional backlash, including guilt, stress, and mistrust in future investments

-

Exploitation by recovery scammers, who claim to help retrieve funds—for a fee

-

Lost time and disrupted financial planning, often strenuous to recover

The ramifications go beyond money—they hit your confidence and disrupt lives.

10. How to Protect Yourself

If you’re exploring new platforms:

-

Verify licensing through official regulator directories—FCA, ASIC, BaFin, etc.

-

Start with small withdrawals—if it doesn’t go through, retreat immediately

-

Cross-examine independent review platforms, not just the site’s marketing

-

Review domain registration history—ability to circumvent scrutiny is a red flag

-

Rely on user feedback and community forums—they often spot scams early

-

If in doubt, delay—real investment doesn’t require aggressive urgency

Final Verdict: Avoid ZenFundPro.com Completely

Between formal regulator warnings, zero oversight, fake promises, and disguised tactics—ZenFundPro is a high-risk, unregulated platform almost certainly operating as a scam.

Your funds deserve safety, transparency, and responsibility—traits absent from this operation. Only invest with platforms backed by reputable regulators and verifiable track records. Be skeptical of hype, insist on licensing, and protect your finances wisely.

In the online investing world, skepticism is your best friend—and when caution says “skip it,” you’re probably onto something.

-

Report Zenfundpro.com And Recover Your Funds

If you have lost money to zenfundpro.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like zenfundpro.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.