ZentraWealth.com: Important Information

The rapid growth of online trading and investment services has created alluring opportunities for individuals seeking financial growth. Unfortunately, it has also opened the door for unauthorised and unregulated platforms to attract users with promises of easy profits and professional tools. ZentraWealth.com is one such platform that has recently drawn regulatory scrutiny and raised major concern among financial watchdogs and independent analysts. Based on official warnings and documented red flags, investors should approach this service with the utmost caution.

What ZentraWealth.com Presents Itself As

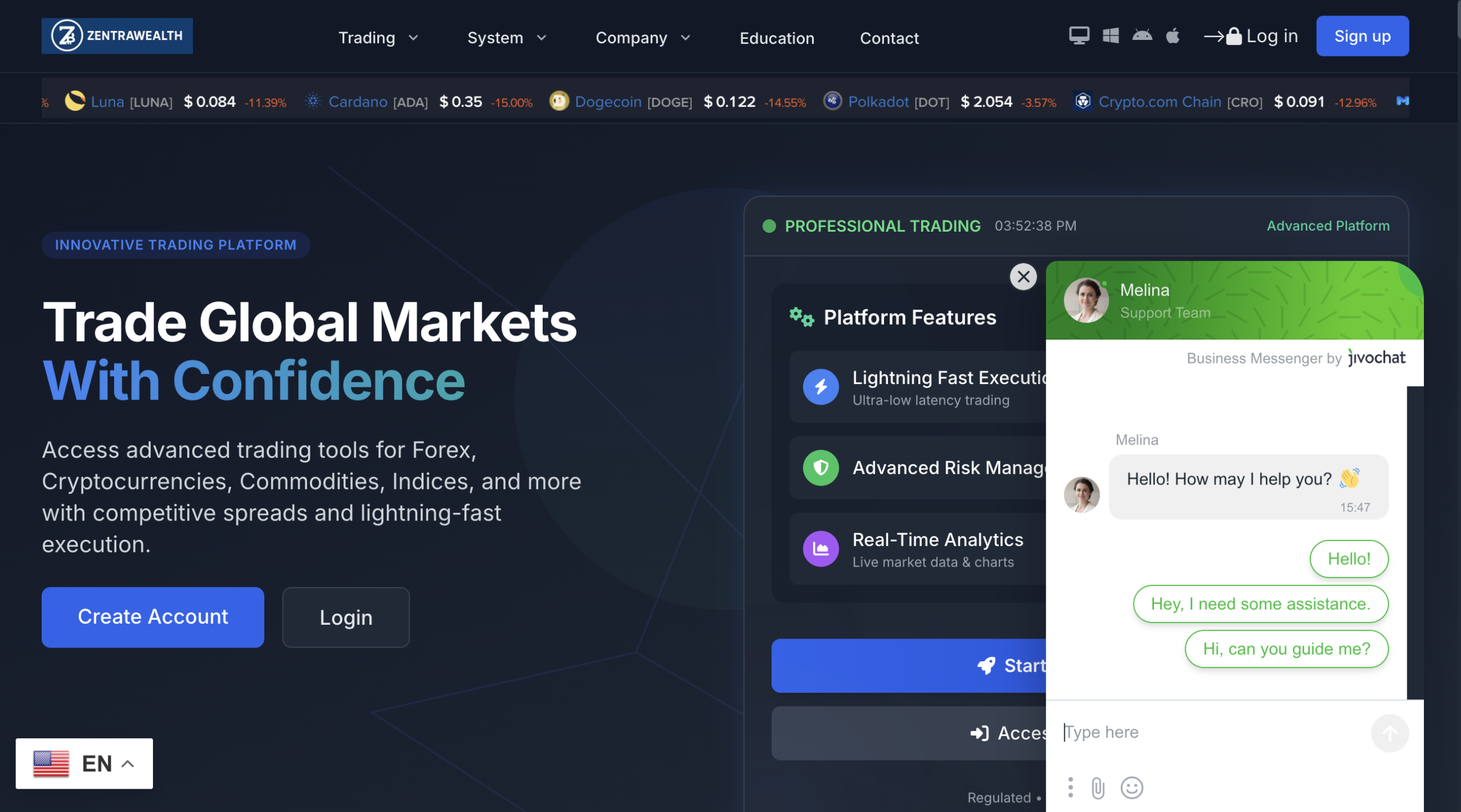

On the surface, ZentraWealth.com markets itself as a sophisticated online trading platform offering access to multiple financial markets, including forex, cryptocurrencies, commodities, indices, and more. Its website highlights features such as advanced trading tools, real‑time execution, social trading options, and account support. It claims to provide professional services to a global client base, often accompanied by graphics portraying high returns and testimonials that imply successful investor outcomes.

However, aggressive marketing language and sleek web design do not equate to legitimacy. Critical investigation into its regulatory standing and business practices reveals significant concerns that cannot be resolved through promotional content alone.

Official Warning From the UK Financial Regulator

One of the most definitive indicators of serious issues with ZentraWealth.com is the fact that it has been added to the Financial Conduct Authority (FCA) Warning List in the United Kingdom. According to the FCA, Zentra Wealth is not authorised to provide or promote financial services in the UK and may be targeting investors there. The regulator specifically advises individuals to avoid dealing with this firm due to its lack of proper permission.

Being on an FCA warning list is a substantial red flag. The FCA’s role is to regulate financial services firms operating in or targeting UK investors, enforcing rules designed to protect consumer interests. If a platform is not authorised — and explicitly appears on the regulator’s warning list — it means that:

-

It is operating outside recognised legal oversight.

-

It has not met required standards for financial services providers.

-

Investors dealing with it have no access to the FCA’s complaint resolution services if problems arise.

-

Investors are not protected by compensation schemes like the Financial Services Compensation Scheme (FSCS), which applies only to authorised firms.

These protections exist precisely to protect consumers when a financial provider fails or engages in misconduct. Their absence significantly increases exposure to financial loss.

Regulatory Claims vs. Reality

Despite bold claims on its website about being “regulated,” independent checks reveal that ZentraWealth.com is not registered with respected financial authorities. Third‑party monitoring and broker information services indicate that statements about regulatory licensing may be misleading or entirely false. Reputable regulators such as the Seychelles Financial Services Authority (FSA) and the Cyprus Securities and Exchange Commission (CySEC) do not appear to have records matching the platform’s claimed licences, and the FCA warning reinforces that it has no recognised registration.

This kind of discrepancy — claiming regulation without backing evidence — is a common tactic used by unauthorised services to create a false sense of legitimacy.

Technical and Trust Signals Raise Additional Concerns

Independent web evaluation tools have flagged ZentraWealth.com as having a very low trust score. Sites with low trust scores typically exhibit a combination of warning signs such as:

-

Recent domain registration and limited online presence.

-

Hosting on servers shared with other low‑trust or high‑risk entities.

-

Lack of verifiable corporate ownership and hidden WHOIS data.

-

Presence of high‑risk financial service indicators like cryptocurrency and CFD trading services without transparent licensing.

While a low trust score alone does not conclusively prove malicious intent, when combined with official regulatory warnings it creates a strong case for extreme caution.

Common Red Flags in Unauthorised Investment Platforms

Platforms operating without reputable oversight often exhibit patterns that jeopardise investor security:

-

Misleading Testimonials

User success stories and claimed profit figures may be fabricated or unlinked to real verified accounts. -

Pressure Marketing

Solicitation through unsolicited calls, emails, or social media messages urging immediate account deposits. -

Opaque Withdrawal Conditions

Difficulty or delay in withdrawing funds once deposits are made, sometimes coupled with requests for additional “verification” payments. -

Claims of Regulation Without Verification

Stating that the service is “regulated” or “secure” without listings in official registries.

Such tactics are consistent with profiles of unregulated and deceptive financial operations, and they are widely documented across financial watchdog advisories.

Why Investor Protection Is Crucial

Legitimate financial services platforms are required to demonstrate ongoing compliance with regulatory standards. These include maintaining adequate capital reserves, segregating client funds, providing transparent disclosures, and undergoing regular audits. Regulated firms also participate in compensation schemes that protect investors if something goes wrong.

When a firm is not authorised, none of these safeguards apply. Investors are left without basic protections and may face difficulties in recovering funds or seeking dispute resolution. The FCA’s warning explicitly highlights the absence of such protections for individuals dealing with Zentra Wealth.

Final Assessment: Proceed With Extreme Caution

Based on publicly available regulatory information, third‑party trust assessments, and known patterns of unauthorised platforms, ZentraWealth.com exhibits multiple serious concerns that make it unsuitable for investors seeking a safe, professional, and compliant trading environment. Its inclusion on the FCA warning list and unverified regulatory claims are especially alarming.

Before engaging with any online investment platform, it is essential to verify its licence status with official regulatory bodies and ensure that it meets formal compliance requirements. Doing so helps safeguard your financial interests and avoid platforms that may operate outside legal and ethical boundaries.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to zentrawealth.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as zentrawealth.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.